Economic development planners trying to spread the innovation economy beyond Boston wish more entrepreneurs would follow the lead of Julie Bliss Mullen, CEO of water treatment company, Aclarity. Eschewing Boston, unlike most of her peers, the 2019 Forbes 30 Under 30 located the company in Springfield’s Innovation Center. Aclarity’s technology was invented while she was a PhD candidate at UMass Amherst. The company announced a $1,000,000 pre-seed round financing in August 2019.

Venture capital disproportionately targets the most promising young startups and plays a critical role in turning these startups into engines of economic growth. In 2019, Aclarity’s deal was 1 of only 9, representing 3% of the statewide total, outside Greater Boston, defined as the arc created by I-495, compared to 51 or 13% of the deals in 2009.

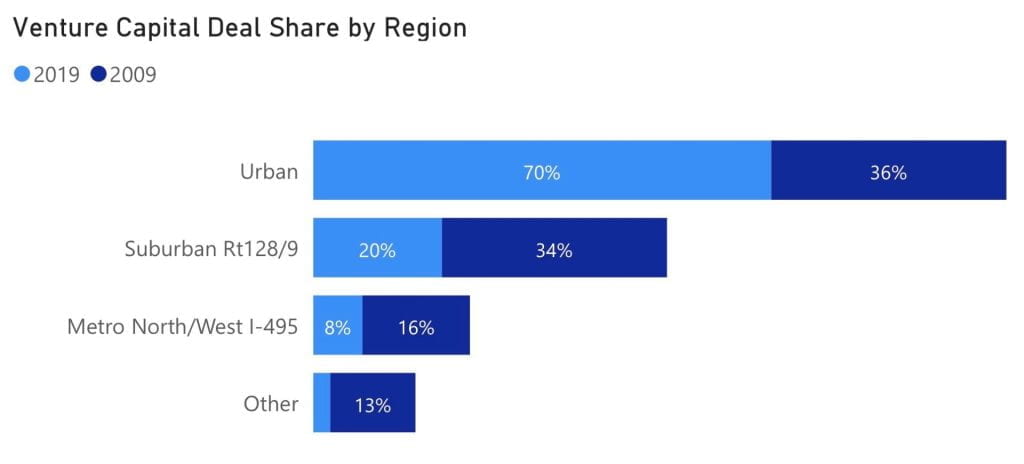

The massive shift of deal volume to the inner urban core – Boston, Cambridge, Somerville – has been at the expense of the I-495 cities and Rt 128 suburbs as well as the rest of the state. In 2019, 70% of the venture capital deals (totaling $9,063,702,418) were in the inner urban area, compared to 36% in 2009. In 2019 20% of the deals were in the Rt. 128 suburbs; and 7% in the I-495 corridor. In 2009, the suburbs had 35%, and I-495 16%.

There’s long been an assumption among economists that tech, like earlier industries, would inevitably spread out its operations and wealth, as people and firms are priced out of the urban area’s most popular neighborhoods, like Cambridge’s Kendall Square and Boston’s Financial District. But young venture backed tech companies are mostly staying in the urban area.

There’s long been an assumption among economists that tech, like earlier industries, would inevitably spread out its operations and wealth, as people and firms are priced out of the urban area’s most popular neighborhoods, like Cambridge’s Kendall Square and Boston’s Financial District. But young venture backed tech companies are mostly staying in the urban area.

Comparing deal volume in 2018 and 2019, Boston (40% to 37%) and Cambridge (27% to 24%) had decreases in their share of statewide deals. But Somerville, which had 9 deals in 2018, had 17 in 2019. That is almost three times what the rest of the state grabbed. Other urban neighborhoods such as Medford, Brighton and Allston also increased their share of deals.

Overall, the urban deal share slipped from 73% to 70% due to a spurt of deals in the I-495 corridor. I-495 had 8% of the deals in 2019; and 3% in 2018. The Rt. 128 suburbs had 20% deal share in 2019, compared to 19% in 2018.

Overall, the urban deal share slipped from 73% to 70% due to a spurt of deals in the I-495 corridor. I-495 had 8% of the deals in 2019; and 3% in 2018. The Rt. 128 suburbs had 20% deal share in 2019, compared to 19% in 2018.

Our demographic analysis is based upon information from VentureDeal, publicly reported debt and equity investments by angel groups, venture capitalists, corporations, etc. We looked at the deal volume because it is a better indicator of a region’s health than deal amount. It is less prone to wild shifts from the presence or absence of large financing transactions.

The analysis shows that locations along Rt 128 and I-495 still have their appeal to venture backed companies, although not nearly as much as in the past. But the sheer density of the entrepreneurial community in the urban core offers opportunities that are nonexistent elsewhere, and makes it the center of activity.

There are a dozen tech and life science oriented development projects underway around the urban core now. They span from Cambridge, Somerville and Watertown to South Boston, Charlestown, the Seaport District, and Allston. Even outlying universities are moving closer to the action. The latest is the UMass campus in rural Amherst, which acquired the Mount Ida College real estate and facilities in suburban Newton with the goal to align its students, research and development, and faculty more closely with the business community in Greater Boston.

Still, there is hope for outlying areas of the state. Aclarity attributes its Western Massachusetts location to the early support of Valley Venture Mentors in Springfield. The Maroon Venture Partners Fund, created by MassMutual (headquartered in Springfield) and the Alchemy Group provided Aclarity’s financing. Financing for the Springfield Innovation Center, which formally opened in January 2020 was provided by grants and loans from MassDevelopment, the state’s economic development finance agency.